Home > Industries > Financial Services

Financial IT Solutions

Transform your financial enterprise with Adsgrill’s cutting-edge Fintech software solutions, designed to address the dynamic needs of the digital age.

Empower your financial enterprise with IT solutions

Adsgrill’s Fintech software solutions integrate IT services as a core component, delivering innovation, security, and efficiency to drive success in the evolving financial landscape.

Fintech (financial technology) software development services encompass a wide range of solutions tailored to the needs of financial institutions, startups, and businesses operating in the finance sector. These services typically include

- Custom Software Development

- Mobile App Development

- Blockchain and Cryptocurrency Solutions

- Payment Processing Solutions

- Robo-Advisory Platforms

- Regulatory Compliance Solutions

- Data Analytics and Business Intelligence

- API Integration Services

- Cloud-Based Solutions

- Security Solutions

Fintech Customers We Serve

Custom Financial Software Development

Financial ERP System

Digital Startups in Fintech

Mobile and Web Applications

Accounting Software

Cyber Security

Why Choose Us?

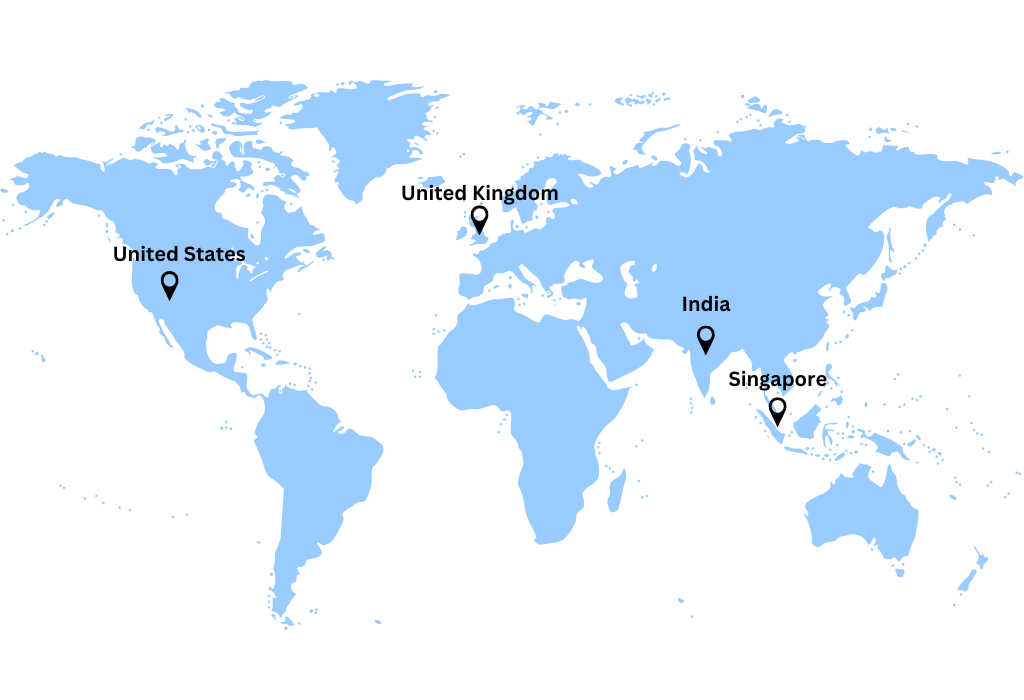

Adsgrill (and Partners) provides high-quality Fintech solutions across the BFSI sector, blending innovation, security, and efficiency to tackle the unique challenges and seize the opportunities within each segment.

Custom Software Development for Fintech by Adsgrill offers tailored solutions designed to meet the specific needs (Like : website, mobile app, ERP and CRM) of financial institutions and businesses. With a focus on security, scalability, and compliance, we crafts innovative software that ensures seamless integration with existing systems while enhancing operational efficiency. By leveraging cutting-edge technologies such as AI, machine learning, and blockchain, Adsgrill enables businesses to offer advanced services like automated fraud detection, predictive analytics, and streamlined transaction processing. Their custom solutions not only improve user experience but also provide the flexibility and agility needed to thrive in the fast-evolving financial landscape.

Transforming Finances Through Tailored Technology.

Custom Software Development For Fintech

Advanced Technology Integration

Utilize the latest technologies to enhance financial services, improving transaction speed, accuracy, and customer experience.

Adsgrill’s Fintech solutions leverage the latest technologies to revolutionize financial services, driving significant improvements in transaction speed, accuracy, and overall customer experience. By integrating advanced programming language like python and javascript and tools like artificial intelligence, blockchain, and machine learning, we enhance the efficiency and reliability of financial transactions, ensuring faster processing times and minimizing errors. These innovations enable businesses to offer real-time services, personalized experiences, and data-driven insights that foster customer satisfaction and loyalty. With Adsgrill’s solutions, financial institutions can stay ahead in a competitive market by delivering seamless, secure, and innovative financial services.

Automation and Efficiency

Streamlines financial processes through automation, reducing manual efforts, minimizing errors, and improving operational efficiency.

We streamlines financial processes through our custom ERP and CRM or our partner’s advance solutions that help in automation, significantly reducing manual efforts and minimizing the risk of human errors. By automating key tasks such as transaction processing, compliance checks, data entry, and customer service operations, Adsgrill enhances operational efficiency across all financial functions. This automation allows businesses to operate faster, more accurately, and at a lower cost, enabling staff to focus on higher-value activities while ensuring smoother, more reliable service delivery. With Adsgrill’s automation solutions, financial institutions can improve productivity, cut operational costs, and maintain a high level of service quality in a rapidly evolving financial landscape.

Seamless User Experience

Delivering intuitive, user-friendly interfaces to improve customer engagement and satisfaction.

We focuses on delivering intuitive, user-friendly interfaces that enhance customer engagement and satisfaction. By prioritizing simplicity and ease of use, our Fintech solutions ensure that users can navigate complex financial services with ease and confidence. Whether accessed through mobile devices, desktops, or tablets, Our interfaces provide a seamless experience across multiple platforms, ensuring smooth operation and consistent performance. This approach not only improves customer satisfaction but also boosts user retention by making financial services more accessible, engaging, and efficient. With Adsgrill’s design philosophy, financial organizations can foster stronger customer relationships and drive long-term loyalty.

AI and Data Analytics

Enable financial organizations to gain valuable insights, optimize decision-making, and enhance predictive capabilities.

By integrating artificial intelligence (AI) and data analytics, we empowers financial organizations to unlock valuable insights, streamline decision-making, and enhance predictive capabilities. AI-driven solutions analyze large volumes of financial data in real-time, identifying patterns, trends, and anomalies that might be missed by traditional methods. This enables businesses to make data-backed decisions faster and more accurately, from optimizing investment strategies to predicting market shifts. With advanced predictive models, financial institutions can proactively manage risks, improve customer targeting, and deliver more personalized services. Our integration of AI and data analytics transforms financial operations, driving efficiency and fostering innovation in a competitive market.

Scalability and Flexibility

Scalable to accommodate business growth, ensuring that financial institutions can adapt to changing market conditions and customer demands.

Adsgrill’s Fintech solutions are designed with scalability in mind, allowing financial institutions to easily accommodate business growth and adapt to ever-changing market conditions. As financial organizations expand or evolve, Adsgrill’s flexible solutions ensure that systems can scale seamlessly to handle increased transaction volumes, new service offerings, and more complex customer demands. Whether it’s expanding into new markets, adding advanced features, or responding to regulatory changes, Adsgrill’s solutions provide the agility and robustness required to stay ahead in a dynamic financial landscape. This scalability helps businesses maintain operational efficiency and deliver high-quality services without disruption, supporting long-term growth and success.

Security and Compliance for the Fintech

We offer solutions with advanced encryption, fraud detection, and compliance with industry regulations.

We place a strong emphasis on security, offering Fintech solutions that incorporate advanced encryption techniques, real-time fraud detection, and strict adherence to industry regulations to protect sensitive financial data. By leveraging cutting-edge security protocols, We ensures that all transactions, customer information, and financial records are safeguarded against unauthorized access, data breaches, and cyber threats. Their solutions are designed to meet global compliance standards, such as GDPR, PSD2, and AML regulations, ensuring that businesses remain secure while also adhering to legal and regulatory requirements. With Adsgrill’s robust security features, financial institutions can confidently protect their clients’ data and maintain trust in a complex digital landscape.

Fintech Industry Solutions-FAQs

What services does adsgrill Fintech offer?

Adsgrill Fintech specializes in providing software development services tailored specifically for the fintech industry. This includes developing custom fintech applications, integrating payment gateways, building financial analytics platforms, creating trading platforms, and much more.

How does adsgrill Fintech ensure the security of its software solutions?

Security is a top priority for Adsgrill Fintech. They employ industry best practices and rigorous security measures throughout the software development lifecycle to mitigate potential threats and vulnerabilities. This includes conducting regular security audits, implementing encryption techniques, and following secure coding practices.

Does adsgrill Fintech provide ongoing support and maintenance?

Yes, Adsgrill Fintech offers comprehensive support and maintenance services to ensure the smooth operation of your fintech software solution post-deployment. This includes troubleshooting issues, applying software updates, and providing technical assistance as needed.